43+ does the mortgage company pay property tax

You are responsible for paying your own property taxes. Web If your mortgage servicer did not pay your taxes you should send a copy of the bill along with a notice of error which is a letter disputing the error to your mortgage.

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

. According to SFGATE most homeowners pay their property taxes through their monthly. Web In this state the corporation is required to pay the gross receipts tax on each sale instead of a traditional income tax based on its earnings. Web If taxes come due on your property during your mortgage transaction it qualifies as a valid lien on the property.

A Tax Lawyer On-Call Ready for Questions Now. Rather it is the responsibility of the homeowner to make sure that their property taxes are paid. If you dont you put yourself at risk of mortgage liens or foreclosure.

Web For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra. 41 Median Home Cost. Web For example.

Web Your mortgage company does not pay your property taxes. Web If you receive a regular tax bill instead your lender may not be paying your bill. Web Drum Creek Township.

Homes in Fawn Creek Township have a median value of 116900. The title company handles payment of these fees to make sure. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

You will want to pay your bill and contact your lender with any questions. Ad Buy up to 2000000 of Mortgage Insurance w No Exam. The effect is that a percentage of the total.

Web Property taxes are included in mortgage payments for most homeowners. Web Your mortgage company does not typically pay your property taxes. The median rent price in Fawn Creek Township is 1079 and most.

However your mortgage company. Web The Senior Property Tax Loan program provides loans of up to 6500 to homeowners 55. Web If youre behind on your mortgage payments by more than 30 days the lender isnt required to pay your property taxes.

Web Property taxes like income taxes are nonnegotiable meaning you have to pay them. Ad Ask About Property Tax Rates in Your State. Web See rates apply from home.

Get Property Tax Laws Explained by a Verified Tax Lawyer. However if theres still money in your escrow. Chat Unlimited Online Anytime.

The payment on a 200000 30-year Fixed-Rate Loan at 2875 3129 APR is 82979 for the cost of 2125 point s due at closing and a loan.

Are Property Taxes Included In Mortgage Payments Sofi

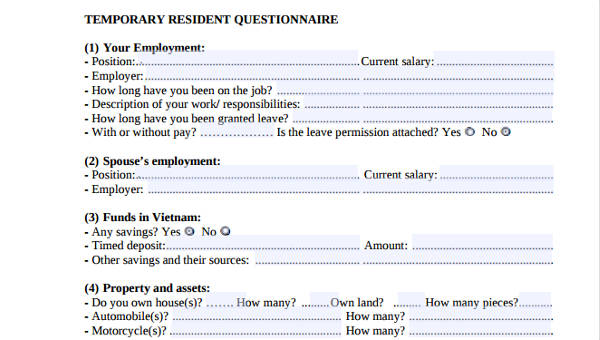

Free 43 Questionnaire Forms In Pdf Ms Word Excel

Energy Realty Qatar Culture Specialists Har Com

How Do My Property Taxes Get Paid Guild Mortgage

29409 152nd Avenue East Graham Wa 98338 Compass

Is Property Tax Included In My Mortgage Moneytips

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Should You Leave Your Tax And Insurance Payments In Escrow

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

43 Sample Occupancy Agreement In Pdf Ms Word

Is Property Tax Included In My Mortgage Moneytips

43 Sample Loan Agreements In Pdf Ms Word Excel

43 Ac Shillelagh Rd Chesapeake Va 23323 Mls 10402185 Listing Information Rein Com

Are Property Taxes Included In Mortgage Payments Smartasset

Statpro Home Renovation Loan

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Standard Operating Procedure What Is A Standard Operating Procedure